Evaluating the Impact of Technology on the Global Financial System

Create and release your Profile on Zintellect – Postdoctoral applicants must create an account and complete a profile in the on-line application system. Please note: your resume/CV may not exceed 2 pages.

Complete your application – Enter the rest of the information required for the IC Postdoc Program Research Opportunity. The application itself contains detailed instructions for each one of these components: availability, citizenship, transcripts, dissertation abstract, publication and presentation plan, and information about your Research Advisor co-applicant.

Additional information about the IC Postdoctoral Research Fellowship Program is available on the program website located at: https://orise.orau.gov/icpostdoc/index.html.

If you have questions, send an email to ICPostdoc@orau.org. Please include the reference code for this opportunity in your email.

Research Topic Description, including Problem Statement:

Emerging technologies are rapidly changing the way that the global financial system functions – including online banking, cryptocurrencies, blockchain-based transactions, and central bank digital currencies. Technologies can now offer countries mechanisms for operating outside of what we now consider global financial system norms and allow them to define their own ways of conducting transactions within their borders. They even have the potential to render commercial banks as non-competitive or irrelevant. However, many skeptics believe these technologies are passing fads and that the global financial system, and the U.S.’s pre-dominant role in it, are stable and will not be drastically altered by these financial technologies (FinTech). As countries that are adversarial to the United States seek to unseat the dollar as the world’s reserve currency, they are investing significant funds into different technologies that they believe will help them achieve their aims. If these adversaries succeed, the United States could lose jurisdiction over any financial crimes associated with transactions occurring outside of the U.S. dollar, to include support to terrorism and weapons of mass destruction (WMD) proliferation. In addition, the United States may lose its ability to effectively level sanctions against, or designate, entities that violate international laws or treaties or that have the potential to cause financial instability in global markets. The United States should prepare for the most likely scenarios in which emerging FinTech and other technologies enable other countries to subvert current global financial system norms and determine how those scenarios can be overcome, protecting our status in the global economy. The United States should also be prepared to identify potential “black swan” events that could revolutionize the financial playing field in ways we do not yet understand – presenting strategic surprise -- and identify root causes and driving factors that are particularly sensitive to certain global or technical events. Applying new statistical and artificial intelligence approaches to historical examples, as well as possible future scenarios, coupled with deep expertise in economics, finance, and emerging and evolving alternative banking mechanisms could result in useful new insights that the counterproliferation community needs to consider.

Example Approaches:

This project should leverage all available information as well as recent breakthroughs in applied statistics, artificial intelligence, and deep learning to determine the most likely scenario(s) for how technologies will impact the global financial systems, which scenario(s) is most likely to have the largest impact and why, and in what timeframe this scenario(s) could unfold. It should also detail the impact of emerging FinTech or potential U.S. dollar status loss on the United States, its economy, and national security. Further, the proposers should consider scenarios or events that would undermine this thinking and identify root causes and driving factors. Applying new approaches to considering risk and evaluating a range of future outcomes would be essential to developing a solid fundamental understanding of potential futures and enabling the Intelligence Community to develop strategies to anticipate developments and to identify and warn of emerging risks and vulnerabilities as early as possible.

Relevance to the Intelligence Community:

FinTech is a rapidly growing field that presents many opportunities for financial entities to improve customer relations, efficiency of transactions, scalability, and security. However, it also offers new mechanisms for self-reliance, global remittances, and peer-to-peer transactions that require no third parties for settlement. These changes could drastically change the global financial system and different countries’ status in it, particularly the status of the United States. We are concerned about the status of the United States in the global financial system because currently we are able to impose and enforce sanctions on entities that violate treaties or international law – results essential to counterproliferation and counterterrorism activities. For example, sanctions are imposed when countries or their citizens develop or expand military or weapons programs that are considered dangerous to the international community. Additionally, having U.S. dollar transactions settled through the United States gives U.S. law enforcement the jurisdiction to investigate, as well as charge and convict perpetrators of, financial crimes such as money laundering, fraud, and terrorist financing. Lastly, the U.S. dollar is currently the safest currency in which to conduct international business transactions. This gives the United States global economic dominance. Evolving and emerging FinTech could enable changes that lead to the disappearance of these national security advantages and leave the United States increasingly vulnerable to a range of potentially preventable adversarial technological and strategic developments. This project should be instrumental to positioning the national security community to anticipate, prepare for, and defeat a range of financial and technological scenarios posing significant risks of inducing economic crisis.

Key Words: Economy, Finance, Sanctions, Banking, Currency, Virtual Currency, U.S. Dollar, Risk Management, Statistics, Artificial Intelligence, Deep Learning, Financial Technologies, FinTech, Blockchaining, Cryptocurrency

Postdoc Eligibility

- U.S. citizens only

- Ph.D. in a relevant field must be completed before beginning the appointment and within five years of the application deadline

- Proposal must be associated with an accredited U.S. university, college, or U.S. government laboratory

- Eligible candidates may only receive one award from the IC Postdoctoral Research Fellowship Program

Research Advisor Eligibility

- Must be an employee of an accredited U.S. university, college or U.S. government laboratory

- Are not required to be U.S. citizens

- Citizenship: U.S. Citizen Only

- Degree: Doctoral Degree.

-

Discipline(s):

- Chemistry and Materials Sciences (12 )

- Communications and Graphics Design (2 )

- Computer, Information, and Data Sciences (17 )

- Earth and Geosciences (21 )

- Engineering (27 )

- Environmental and Marine Sciences (14 )

- Life Health and Medical Sciences (45 )

- Mathematics and Statistics (10 )

- Other Non-Science & Engineering (2 )

- Physics (16 )

- Science & Engineering-related (1 )

- Social and Behavioral Sciences (27 )

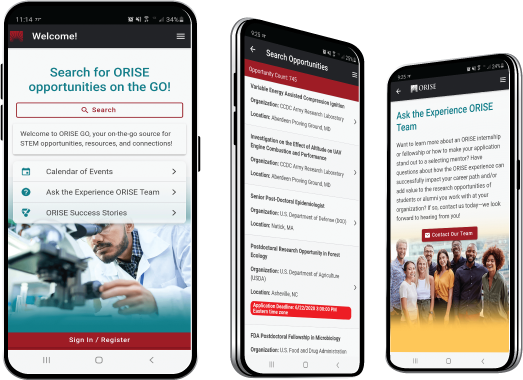

ORISE GO

ORISE GO

The ORISE GO mobile app helps you stay engaged, connected and informed during your ORISE experience – from application, to offer, through your appointment and even as an ORISE alum!